Age-Related Macular Degeneration Market Size, Epidemiology, Trends, and Forecast 2025-2035

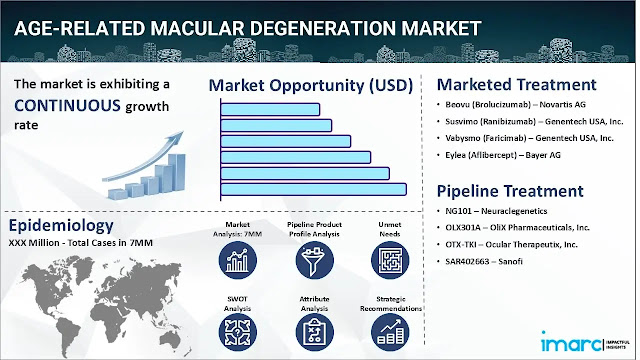

The age-related macular degeneration market size reached a value of USD 10.3 Billion across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 12.2 Billion by 2035, exhibiting a growth rate (CAGR) of 1.61% during 2025-2035.

Age-related macular degeneration remains one of the leading causes of irreversible blindness among older adults. Advances in imaging and pharmacotherapy have brightened the horizon for these patients, yet the condition continues to impose heavy costs on both victims and health systems. This article surveys the trajectory of incidence, innovation, and market activity as observers peer toward 2025.

Two powerful forces shape that landscape: demographic change and an evolving clinical toolkit.

Worldwide, ophthalmologists now diagnose nearly 2.3 million new cases of AMD each year.

In the United States alone, surveys suggest that roughly 10% of Americans over fifty harbor the early drusen-laden form, while 1% live with the advanced wet or geographic-atrophy variants. If demographic projections hold, the pool of affected individuals could swell to around 288 million globally by 2040.

The financial contours of AMD care reflect this surge through capital and import curves. A recent market study pegged the sector at USD 10.1 billion in 2024, and analysts expect a rise to USD 20.88 billion by 2033, translating into a compound annual-growth rate of about 6.94%. Fueling that expansion are ribbon-thin OCT imaging, gene-edited therapies, and new injectable agents that reassure payers as much as patients. Growing awareness of preventive behavior, from dietary lutein to twice-yearly screening, completes the equation.

Recent Advances in Treatment

First-line therapies for wet age-related macular degeneration (AMD) continue to evolve. Anti-vascular endothelial growth factor agents-Eylea, Lucentis, and their off-label cousins-temporarily starve abnormal retinal vessels by blocking a key growth signal. A growing number of clinics now alternate or combine these drugs in search of faster stabilization, yet the core mechanism stays unchanged.

Away from the injection table, low-level light exposure is earning a following. The LIGHTSITE III trial, conducted in multiple EU nations, reported modest but reproducible gains in visual acuity among patients with intermediate dry AMD. The accomplishment nudged the FDA to issue a breakthrough designation, a rarity for therapies aimed at the more stationary dry form of the disease.

Diagnostic Innovations

Technology is also cutting the delay between symptom onset and clinical confirmation. Handheld OCTs and adaptive optics cameras now share floor space with traditional fundus photography, and their resolution is closing in on single-photoreceptor detail. Home-based devices such as ForeseeHOME have capitalized on this trend by asking patients to complete a brief contrast test every other day. Results upload wirelessly, letting a remote algorithm flag potentially sight-threatening transitions.

Challenges and Outlook

Even rapid progress cannot erase the obstacles embedded in most AMD treatment pathways. Monthly injections remain the gold standard, yet the calendar quickly fills when follow-up imaging and other comorbidities are factored in. Cumulative costs reach five figures for some patients, and that number grows steeper if therapy switches damage non-compliant vessels. Until biosimilars prove widely available or toxicity profiles improve, the balance between promise and persistence will remain delicate.

Analysts expect the age-related macular degeneration sector to keep expanding in the coming years. Trial after trial of gene therapies, along with fresh approaches to drug delivery, hints at safer, less disruptive interventions. Demographers warn that a rapidly graying population will only widen the need for new screening gadgets and therapies, so creative pressure in the field shows no sign of letting up.

Request for a sample of this report: https://www.imarcgroup.com/age-related-macular-degeneration-market/requestsample

Countries Covered:

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country:

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the age-related macular degeneration market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the age-related macular degeneration market

- Reimbursement scenario in the market

- In-market and pipeline drugs

This report also provides a detailed analysis of the current age-related macular degeneration marketed drugs and late-stage pipeline drugs.

In-Market Drugs:

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs:

- Drug overview

- Mechanism of action

- Regulatory status

- Clinical trial results

- Drug uptake and market performance

Competitive Landscape with key players:

The competitive landscape of the age-related macular degeneration market has been studied in the report with the detailed profiles of the key players operating in the market.

1. Novartis AG

2. Genentech USA, Inc.

3. Genentech USA, Inc.

4. Bayer AG

5. Neuraclegenetics

6. OliX Pharmaceuticals, Inc.

7. Ocular Therapeutix, Inc.

8. Sanofi

Ask the Analyst for Customization and Explore the Full Report with TOC: https://www.imarcgroup.com/request?type=report&id=7911&flag=A

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

Post a Comment